Data Center Electricity Use III: Make or Buy?

Will data centers wreak havoc on the grid?

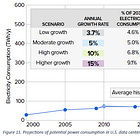

The exponential growth of data centers, driven by the burgeoning demand for cloud services, AI computations, and big data analytics, has increased electricity consumption significantly. In the first two posts of this series, I discussed the increasing data center electricity use, its implications for the electric grid, and how those implications will differ over time due to both demand and supply elasticity.

As data centers proliferate, their energy demands rise, prompting concerns about the grid's ability to handle this surge. Some fear that the electric grid may not be prepared to adapt, potentially leading to instability and higher electricity prices. Those fears may turn out to be overstated. Transaction cost economics can help us understand why.

The fear of increased data center demand causing havoc in electric grid systems is not unfounded. Grid operators have to balance supply and demand in real-time, a task complicated by the intermittent nature of renewable energy sources and the variable load patterns of data centers (although that variability holds the seeds of flexibility). ERCOT in Texas is concerned, very concerned, given population growth and data center expansion. MISO, the grid operator that stretches from Minnesota to Louisiana and covers 14 states (plus Manitoba), anticipates a shortfall of generation capacity in light of demand growth. If data center electricity demand indeed strains the grid, we should expect to see rising grid power prices and longer grid interconnection queues, making grid-supplied power a more costly alternative for data centers.

Alternatives to Grid-Supplied Power

Faced with rising grid costs and potential instability, data centers are exploring alternatives to traditional grid-supplied power. One option is long-term co-location contracts with nuclear power plants: These contracts could offer data centers a more stable and potentially faster supply of electricity. However, these nuclear plants were constructed under a regulatory regime that did not anticipate lucrative large customers "barging the queue".

The owners of roughly a third of U.S. nuclear-power plants are in talks with tech companies to provide electricity to new data centers needed to meet the demands of an artificial-intelligence boom. ...

The discussions have the potential to remove stable power generation from the grid while reliability concerns are rising across much of the U.S. and new kinds of electricity users—including AI, manufacturing and transportation—are significantly increasing the demand for electricity in pockets of the country.

Nuclear-powered data centers would match the grid’s highest-reliability workhorse with a wealthy customer that wants 24-7 carbon-free power, likely speeding the addition of data centers needed in the global AI race.

But instead of adding new green energy to meet their soaring power needs, tech companies would be effectively diverting existing electricity resources. That could raise prices for other customers and hold back emission-cutting goals. ...

The relatively new arrangements mean data centers can be built years faster because little to no new grid infrastructure is needed. Data centers could also avoid transmission and distribution charges that make up a large share of utility bills.

On-site generation is a second option. Data centers can build and operate their own power generators, which offers greater control over energy supply but requires substantial investment in specialized expertise and infrastructure, which data center companies might lack. This option involves data center vertical integration upstream into one of their crucial inputs.

The Make or Buy Decision in Transaction Cost Economics

The "make or buy" decision framework from transaction cost economics helps us understand the choices data centers face. This framework helps firms decide whether to produce goods and services internally or outsource them to external suppliers through market transactions. Key factors influencing this decision include production costs, market competition, uncertainty, and transaction complexity.

Ronald Coase's seminal work, "The Nature of the Firm" (1937), introduced the concept of transaction costs—expenses incurred in making an economic exchange. These costs include finding relevant prices, negotiating contracts, and enforcing agreements. Coase argued that firms exist to minimize these transaction costs, performing certain transactions more efficiently than the market. Firms will expand until the cost of organizing an additional transaction internally equals the cost of executing the same transaction through the market. For a more thorough discussion of Coase's work, my book The Essential Ronald Coase in the Fraser Institute's Essential Scholars series is a good place to start.

Building on Coase's work, Oliver Williamson ("The Economics of Organization: The Transaction Cost Approach," 1981) developed the framework of "efficient boundaries," where firms seek to minimize the sum of production and transaction costs. According to Williamson, firms decide which activities to perform internally and which to outsource based on the complexity and uncertainty of transactions. High complexity and uncertainty often lead firms to internalize production to manage risks more effectively.

Empirical studies have tested these theories across various industries. For example, Walker and Weber (1984) analyzed a U.S. automobile company's make-or-buy decisions, finding that relative production costs were the strongest predictor. They also noted that product complexity and uncertainty influenced the decision to internalize production.

Application to Data Centers' Electricity Decisions

For data centers, the make or buy decision hinges on the costs associated with grid-supplied power versus self-generation. If grid power prices rise due to increased demand and interconnection delays, data centers may find building their own generation more cost-effective. But self-generation involves significant upfront capital investment and operational complexities, so there are tradeoffs.

The complexity and uncertainty of energy supply complicate this decision further. Grid-supplied power offers simplicity but comes with price volatility and potential reliability issues. On-site self-generation provides more control but requires expertise in power systems, regulatory compliance, and maintenance. That expertise entails a significant expansion of the firm to implement that vertical integration. It's a big capital and managerial change.

Transaction costs also play a crucial role. Engaging in long-term contracts with nuclear power plants or other energy providers involves negotiation and enforcement costs. These costs can be substantial, particularly for controversial energy sources like nuclear power. On the other hand, building and maintaining on-site generation involves internal transaction costs related to coordination and management. Again, tradeoffs.

Data centers also have to consider risk management. Grid dependence exposes them to market fluctuations and regulatory changes. Self-generation and vertical integration, in contrast, provides more predictability but requires managing operational risks and potential technological obsolescence.

Strategically, data centers may prefer on-site generation to enhance resilience and sustainability, which are two of the biggest benefits of decentralization. As corporate sustainability goals become more prominent, on-site low-carbon energy sources can align with environmental objectives and provide long-term energy security.

Technological change will shift the margin between buy and make and make it easier and more cost-effective to vertically integrate. In this case that new technology is likely to be small modular nuclear reactors (SMRs). As SMRs move from research to commercialization, each data center may be built with its own built-in SMR. Others, like Helion (backed by Bill Gates), are working on elusive innovations in nuclear fusion.

It Depends

Ultimately, the electricity make or buy decision for data centers is context-dependent. They have to weigh the costs, complexities, uncertainties, and strategic objectives. Right now, rising grid power prices, interconnection delays, and possible limits on co-location with nuclear plants may push them towards self-generation, but the significant investment and expertise required cannot be overlooked.

The insights from transaction cost economics and the make or buy literature offer a useful framework for understanding these decisions. In the dynamic landscape of energy and technology, the optimal solution may vary over time and across different regions. As always in economics, the answer to the make or buy question is "it depends".

I would suggest including in your "make or buy" equation the possibility to buy at fixed price long term either directly from generators or from a utility. This "buy" option reduces the market volatility risk, and avoids owning the development and operating risks and a "make" option has (the requirement of data centers is to procure massive amounts of "green" electricity, and not necessarily owning the technology that generates it).

Of course, location of the data center and availability of third party long term energy contract is the key topic. If there is not available capacity in that market area, or there are not energy players willing to sell long term at fixed price, in that case the data center might decide to make it, externalizing the O&M costs to a third party player.

Make or buy works 2 ways. Utilities could buy data centers or data centers could buy utilities (as well as just buying a generator).

As a related matter, Neal Stephenson's terrific novel Fall examines what happens if it becomes possible to upload our consciousness to the web. One consequence is that many of the rest of us get jobs generating electricity to sustain the uploaded, and to earn enough to get ourselves uploaded.