Is Network Reliability a Public Good?

You keep using that word ...

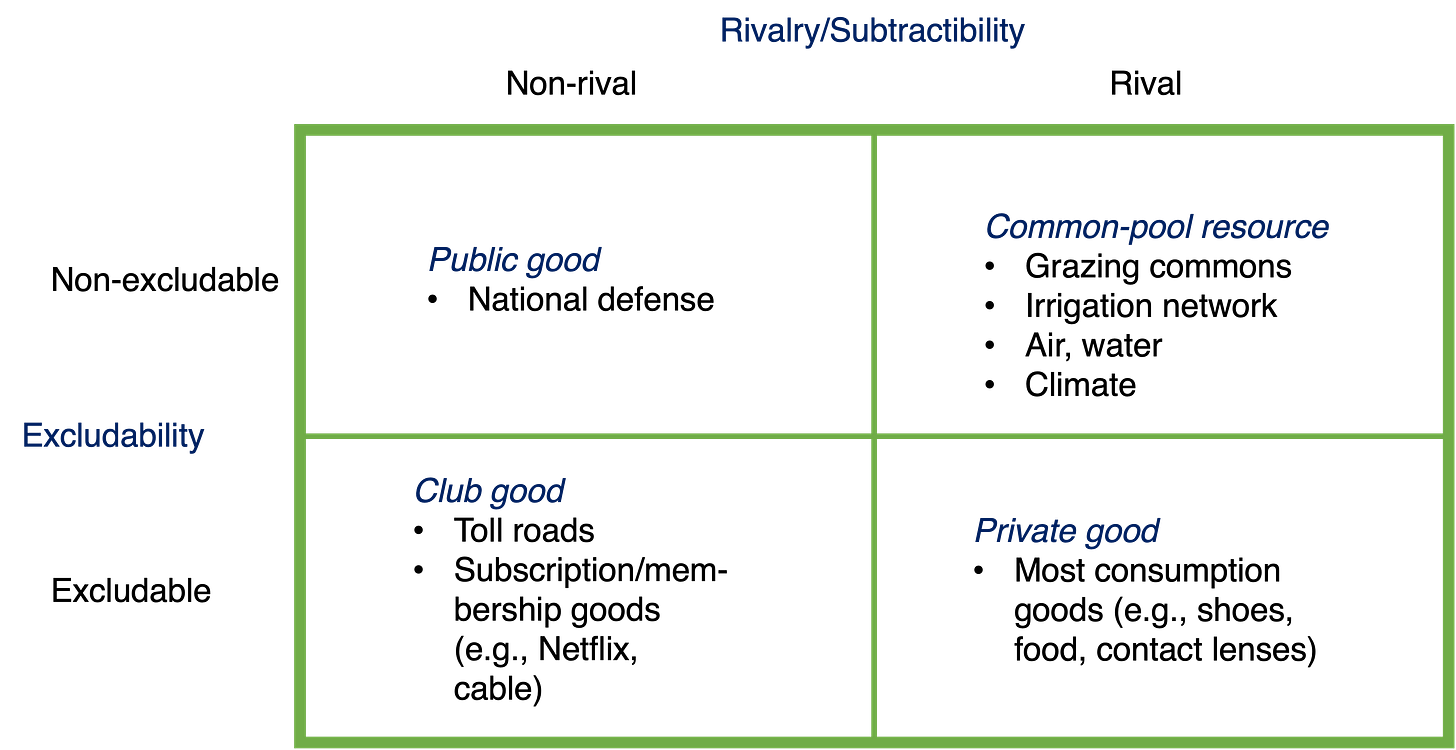

Last week in talking about public choice theory and its implications I mentioned the category of goods called club goods – goods that are excludable but non-rival.

Club good is one of the four types of economic goods categorized by how hard it is to exclude a non-payer from consuming it, and by how much adding another consumer reduces everyone else’s consumption.

This taxonomy is very useful because it sharpens our thinking about the essential nature of goods, how we consume them, and how we pay for them. Excludability tells us something about how costly or even not feasible it is to define and enforce property rights, while rivalry/subtractibility tells us the extent to which one person’s consumption choices are interdependent with consumption choices of others. For me to eat an apple, I have to buy it (or pick it from my own tree), and if I eat that apple it’s no longer available for anyone else to eat. At the polar opposite, national defense is the canonical example of a public good in its technically accurate definition. The other thing that this taxonomy sharpens is how both excludability and rivalry are continua between extremes, even though presented here as two discrete cases of each. In terms of rivalry, for example, there’s a continuum of congestion between being 100% non-rival (such as a specific broadcast radio frequency for a radio station) and 100% rival (such as my apple). I’m planning to dig in to this continuum discussion in future posts.

Often you hear someone refer to some piece of infrastructure or something that has general public value as a public good, even if it’s not technically a public good, not both non-excludable and non-rival. Not everything that has public value is a public good. Almost nothing is a public good that people call a public good; I have a hard time coming up with any example other than national defense. Public goods are extreme cases.

That includes networks like the electric grid. For decades I’ve heard arguments that since everyone is on the grid, we have a shared level of reliability, and that means that reliability is a public good. That argument is incorrect in many ways. I’ve written about this before, by myself (Chapter 8) and in collaboration with Mike Giberson and Evens Salies (ici si vous voulez le lire en français).

Source: Nature

Some current policy discussions in electricity do not incorporate careful enough thinking about the argument that network reliability is a public good. To set up some further analysis of issues like reliability, resilience, and planning to have adequate system resources for things like winter storms, the following is a slightly edited post I wrote on the subject in 2004, when Mike and I were in the midst of thinking more systematically about this issue.

Say there is a group of agents who are connected on a network, and their participation in the network generates benefits for each of them. In the case of electric power, being connected to the grid enables agents to buy power from agents who produce and sell power, meaning either that consumers don’t have to produce it themselves, or that they don’t have to buy it from the nearest producer. [2023 me would like to add that this network connection increases the extent of the market, and I’m surprised that 2004 me didn’t say that.]

Being connected through a network generates benefits for the connected agents, and naturally these benefits come at a cost. In addition to the cost of building the network, there is an additional cost of ensuring that the network will operate reliably for the agents using it. Ensuring a particular level of reliability requires investing in network capacity, particularly in peak hours, because one of the biggest causes of reliability reduction on all networks (electric, cell phone, Internet, highways, airports, etc.) is congestion. Does the network have sufficient capacity to provide reliable service in high-congestion periods?

Several different means exist for providing this capacity. One is to build more transmission wires, so the overall capacity constraint becomes less binding. Another is to build generation closer to consumer agents, using the network less. [2023 me would add here the option of self-supply from distributed energy resources, an option that was not economical in 2004 and that also doesn’t really apply to the other types of networks I listed above.]

These approaches are costly in several ways. First, obviously, is high capital costs. Second, building more generation capacity closer to load has NIMBY costs, and in a large sense defeats the purpose of being interconnected on a network. But there are other means. We can use voltage-management technologies such as springs or shock absorbers at various points in the network. We can ensure that we have good incentives and good capacity for reactive power to balance local network flows. And we can use demand response as a form of capacity building, empowering customers to choose from among a portfolio of contracts that could include real-time pricing, peak-load pricing, or fully-loaded flat rate pricing. Such pricing flexibility has proven and demonstrable benefits for networks, particularly in getting the most bang for the buck out of the existing network capacity without risking to o much loss of reliability. In other words, demand response promotes reliability by using price to increase the network’s load factor. Voltage management technologies and reactive power capacity also enhance network load factor without a cost of loss of reliability [2023 me would add dynamic line rating to this list]. They represent investments in reliability.

The thing about such investments, though, is that when one network agent invests in one of these reliability assets, all of the rest of the connected agents benefit, and the one who pays can’t always exclude the others from benefiting. So that makes reliability a public good, right? And if we apply standard neoclassical public good theory, the fact that reliability is non-excludable and non-rival means that no one will want to invest in reliability because he/she will not capture all of the additional benefits from the additional investment. Thus we can expect underprovision of reliability unless we have some central coordination to require network agents to pay for the investments in reliability that benefit all of them.

This application of public good theory is misguided, and the resulting policy implications are likely to be inappropriate and costly (and therefore produce inefficient outcomes). For insight into why this pure public good treatment of reliability is misguided, I recommend to you an unjustly under-read paper in economics: James Buchanan and Craig Stubblebine, Externality, Economica 1962 [n.b. public goods are just a special case of externality]. Buchanan & Stubblebine start from a standard neoclassical model, where agents maximize utility subject to their budget constraints. But, as in the case of public goods, their agents have interdependent utilities in the sense that one good is consumed jointly, and the total amount available for consumption is a function of the choices of all of the agents. They then go on to derive efficient provision levels and optimality conditions for their model.

Buchanan & Stubblebine provide major insights in analyzing the reasoning underlying the “it’s a public good, and therefore underprovided in equilibrium” result, which I stated above as “no one will want to invest in reliability because he/she will not capture all of the additional benefits from the additional investment”. The flaw in this logic is a straightforward consequence of economic thinking: it’s incorrect because it overlooks the fact that if the agent’s marginal benefit from making the investment exceeds the marginal cost, she’ll do it, regardless of whether or not she can capture all of the marginal benefits. As long as she enjoys enough of them herself, she’ll invest in reliability assets, and there will be no underprovision in equilibrium.

The implications of this insight are profound. First, note that it takes advantage of the fact that different agents on the network are going to have different preferences over reliability. These different preferences mean that for a given level of reliability, some agents will have high marginal benefits and some will have low marginal benefits. That heterogeneity of preferences means that reliability is both a public good and a private good. Yes, individual production and consumption of reliability are interdependent, but when we recognize the diversity of preferences over reliability, the next logical step is to acknowledge that for high marginal value agents, reliability is a private good for which they are willing to pay beyond the lower levels that low marginal value agents would prefer.

That observation leads to the second major implication of the Buchanan & Stubblebine argument. If some agents are willing to pay for more reliability given that it does have private good aspects, then if left to their own investment choices, high marginal value agents would invest to a level beyond what would satisfy low marginal value agents. In other words, high value agents choosing to pay for higher reliability would satiate low value agents. Thus in the sense in which reliability is a public good, there are going to be cases in which the marginal value of additional reliability to a low value agent is essentially zero. In that case the low value agent is satiated, there is no externality at the margin, and any interdependency/externalities at the margin occurred at lower levels of reliability. High value agents wouldn’t stop there, though, if their private marginal benefit from reliability were still higher than their private marginal cost. Technically, this means that the interdependence experienced on the way to getting to equilibrium is a case of inframarginal externalities. Such externalities do not affect the amount of reliability provided in equilibrium, because at the margin the high value agents determine that level and the low value agents are satiated. The policy implication of this? If the low value agents are free riding, so what? It doesn’t affect the efficient outcome, if the environment is structured in such a way that the high value agents face incentives to “walk the talk” and invest in reliability (gee, like, maybe, markets?). And if the low value agents are forced to invest, then in the worst case you get over-investment in reliability, and in the best case it’s an income transfer from the low value agents to the high value agents. How fair is that?

The third implication of this argument is that in an efficient equilibrium, there will still be un-internalized externalities. It’s just that the un-internalized effects, which are inevitable consequences of interdependence on networks, are small enough at the margin that even if they were internalized, they would not change the actual outcome, the actual investment in reliability.

The fourth implication is that the only externalities that should matter, i.e., be policy relevant, are those that would affect the actual outcome in equilibrium. That’s what economists usually mean when we say “underprovision”. But — if there are effects on agents’ values at the margin (if my failure to invest in reliability has a significant effect on your utility), that means that there are unrealized gains from trade and we are leaving money on the table if we don’t negotiate and figure out how to internalize the effects. We could self-internalize by you paying me to invest, and if your payment is enough to get me over the hump, then I do it. If it’s not, then it shouldn’t be done anyway. If this idea sounds familiar to you, it should — this is where the Buchanan & Stubblebine and the Coase “Problem of Social Cost” arguments dovetail. Externalities are not policy relevant if transaction costs are sufficiently low that we can negotiate to self-internalize them. In such cases contractual approaches to policy will lead to superior outcomes relative to regulatory approaches like the imposition of mandatory reliability standards on all agents. The policy implication of this? Focus on rules that reduce transaction costs and foster the development of markets, formal and informal, through which network agents can self-internalize the relevant, inevitable, value effects of their interdependence.

I've read this a couple times and trying to understand it. Economics usually takes some mental digestion for me.

In market/product isolation? If it's a mixed market, then much of that private good will be met by the private providers. So Reliability will be provided by generators and increasingly battery storage. The high reliability segments exit the mixed market and it moves toward a public good thereby decreasing Scale. So equilibrium is a less efficient Public segment.

There haven't been great substitutes, but now PV/battery are reaching cost parity, we start risking a downward spiral that damages the electricity industry. Forward looking utilities are concerned and should be.

Understanding Externalities and lowering Transaction cost make sense. But many of those externalities impact Productivity or public safety which isn't rationalized well. And many utilities aren't behaving rationally, or for personal short-term benefit. It's mind blowing a certain utility has somehow had 2 of America's top 10 bankruptcies.

I must be missing and mangling the argument. But Classic Economics makes a re-occurring error by evaluating complex, social systems in isolation/idealism.

Reliability is most efficiently delivered as a public good, with some exceptions like data centers and hospitals, etc. Agents often don't choose to "self-internalize the relevant, inevitable, value effects of their interdependence." Even when rationally they should. Human nature.

Thanks for the thoughtful piece Lynne. I'm very much enjoying your writing and pay better attention to these areas.