The State Senate is Messing with Texas

Politicizing electricity markets is no way to build system resilience

We need to talk about Texas.

The Texas electricity model, that is – its promise as a fully unbundled, competitive system, its performance during winter stresses like Winter Storm Uri in 2021, and how the Texas legislature is politicizing markets through its attempts to "reform" them by subsidizing natural gas generation and raising costs on renewables.

Some background first, for those of you who don't eat, sleep, and breathe electricity market design and regulatory economics. In the 1990s when lots of states were experiencing nuclear power plant cost overruns and other cost increases like stagnant productivity that raised regulated electricity rates, several US states instituted regulatory restructuring (which I discussed in my first Substack post).

Other countries, most notably England and Wales in the UK, implemented similar changes around the same time. The overarching objective, to improve productivity and reduce costs through competition and innovation, was ultimately designed to result in lower retail electricity rates. Different places took different approaches, with California's the most notorious. Texas started their restructuring initiative a bit later than states like California and Pennsylvania, and incorporated the insights from their experiences as well as England and Wales. The Texas legislature passed its restructuring legislation in 1999, and phased in first wholesale power markets (which had formally opened in 1995) and then retail competition 2002-2007. If you are interested in the Texas model and its design, Andy Kleit and I edited a book, Electricity Restructuring: The Texas Experience in 2009 that you can read in full, with chapters from some of the designers and implementers of the Texas model.

Texas enshrined in the legislation and the mandate to the Texas Public Utility Commission (PUCT) the fundamental idea that competition is a powerful force for consumer protection and innovation. Unlike other restructured states in the US, Texas also quarantined the wires monopoly, not allowing regulated monopoly participation in either competitive wholesale markets or competitive retail markets, as I discussed back in February.

Texas also chose what's called an energy-only market design for the Electricity Reliability Council of Texas (ERCOT) wholesale market when it established its day-ahead and spot markets in 2002. The economics of an energy-only market are straightforward: all sellers receive the market-clearing price in each market interval (and all buyers pay it), which means that the seller of the marginal unit gets paid its marginal cost, but the other (inframarginal) sellers are paid above their marginal cost. That producer surplus is a very important source of revenue that enables generators to pay their fixed costs, and this design provides incentive-compatible rules that align investment incentives with what's called resource adequacy or security of supply – assurance that sufficient resources will be available to meet demand as it fluctuates over time. BUT as demand fluctuates with changes in weather over the day and season, those market-clearing prices can vary. A lot. That variation is an essential element of communicating the important information about relative scarcity and relative value so that investors can identify when and where and what they should invest in. Wholesale price variation that reflects fundamental scarcity pricing is a feature, not a bug, of wholesale power markets.

Politicians and regulators, understandably nervous about how wholesale price volatility would affect electricity customers' retail rates (especially residential customers, and particularly low-income residential customers), struck a political bargain when these nascent markets were being established: price caps. Price caps are a crude policy sledgehammer. They truncate price spikes and reduce price volatility that could lead to increased retail rates; they also truncate producer surplus and undermine investment signals and incentives. If you wish for regulations that keep prices stable, be careful what you wish for, because you are wishing for something that reduces the investments that can keep prices lower (and maybe more stable), and increasingly, investments that can make electricity cleaner.

In systems that have lower prices caps, those undermined investment incentives threatened resource adequacy, so many of them implemented some form of capacity mechanism, either forward capacity contracts or some form of capacity payment separate from energy prices in peak periods. The economic fundamentals of capacity mechanisms are poor – countering the effects of one coarse policy intervention with another coarse policy intervention – but the politics (and the political economy of wholesale power market governance) are more compelling, so capacity mechanisms have grown since the mid-2000s.

ERCOT implemented an energy-only market with a high price cap, thinking that they could escape most of these perverse "missing money" incentives, and for much of the 2000s and 2010s they did. Electricity systems are highly weather dependent, and given the hot, humid Texas summers, the ERCOT system is tailored to summer heat, ventilation of generators, and air conditioning peaks. Resource adequacy was tight in some summers that were hotter and more drought-ridden, but ERCOT avoided widespread outages through both operational decisions and dramatic increases in new generation, first natural gas power plants, then wind, and very recently solar. They also made some changes to their market design, most notably adding a payment mechanism called an operating reserve demand curve to approximate scarcity pricing in periods when prices were at or near the price cap.

But Texas also experiences winter ice storms that can lead to outages. A big one in February 2011 led to a federal regulatory investigation, which concluded that power plant operators should winterize their plants (Mike Giberson wrote several excellent, thorough Knowledge Problem posts about these outages and the investigations). Then on Valentine's Day 2021, ERCOT's grid came within 4 minutes of a massive outage, and some areas were without power in highly unusual below-freezing temperatures for days, with temperatures and ice that caused 210 deaths and also froze water in nuclear power plant control systems and in natural gas wells. 2021's Winter Storm Uri created conditions well beyond those for which ERCOT's wholesale power markets and the electricity system as a whole were designed.

Uri revealed several weaknesses in the Texas model that reduced its resilience, and much has been written in post-mortem to help us understand the complicated causes and invest intelligently in a more resilient system. Long-time KP friend Mike Giberson wrote a definitive and rapid analysis, based on his deep knowledge of ERCOT. Busby et al. (Energy Research & Social Science 2021) highlighted the interdependence of the electric and gas systems and the failure to winterize both, and suggested weatherization, more demand response, and more interstate transmission interconnection. The FERC-NERC regulatory investigation emphasized the weather-related nature of the outages and advocated changing their 2011 weatherization recommendations into reliability requirements. An illustrious and expert group of former Texas PUC regulators (Pat Wood III, Robert W. Gee, Judy Walsh, Brett Perlman, Becky Klein and Alison Silverstein) wrote a report analyzing the early steps that the PUCT and ERCOT and the legislature had taken, and identified the problems to address, including:

Almost half of natural gas, coal, and nuclear generation failed to produce. Some people criticize renewables and hold them to blame for making the ERCOT grid more brittle, but the evidence indicates that frozen water and the interdependence of the electric system and the gas system were the problem. Wind and solar generation actually exceeded what they were "budgeted" for in ERCOT's generation expectations, except for the “load shed” days of February 15-18.

Electricity demand greatly exceeded forecast demand due to the extreme temperatures and poor insulation in housing stock. Electric heat and uninsulated homes cannot withstand days of sub-freezing temperatures. What are some better ways to make lower-quality housing stock more resilient to extreme temperatures? Insulation is a good place to start. This is also an area where digitalization and more demand response would modulate electricity demand and relieve pressure on the grid during extreme events, especially as more people own electric vehicles and battery storage.

Better operational planning at ERCOT, particularly around natural gas availability and forecasting, and more transparent governance including ERCOT and the regulatory agencies in the electric-gas nexus.

Jacob Mays and other co-authors and I (Joule 2022) argued that one essential role that competitive markets play is enabling parties to trade risk, so that risk-bearing shifts to parties who are more willing and able to bear it in return for some expected financial return. Without good contracting to do that, systems like ERCOT end up with underinvestment in resilience. We analyzed the impediments to contracting over risk, and one conclusion we reached is that more enforceable natural gas supply contracts are important and are a definite gap in the current design, and that there are a range of incomplete contracts in the whole supply chain that decouple real-time price formation from longer-term investment decisions; that decoupling leads to underinvestment in resilience.

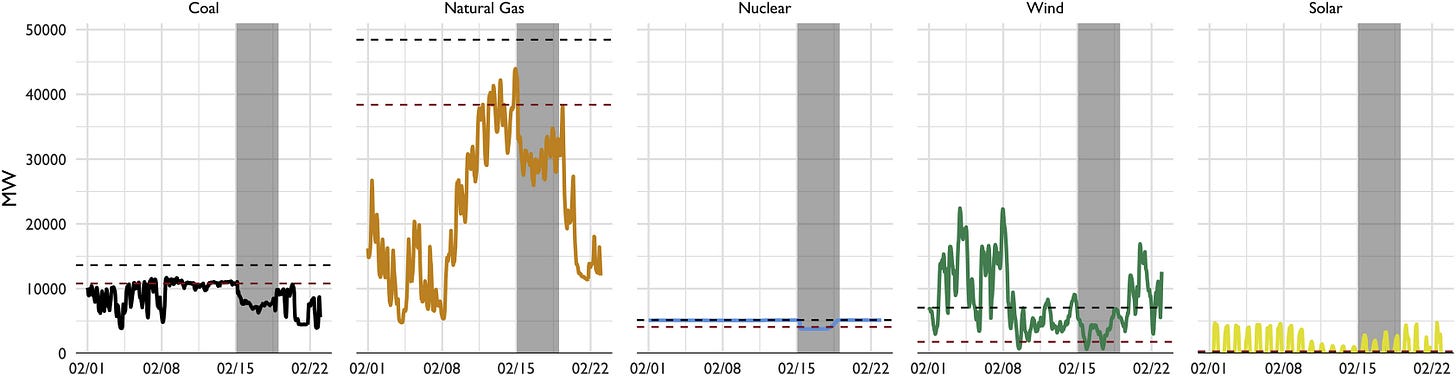

Fast forward to April 2023. Without getting way into the details, three things to note. First, all analysts who have looked at the data pinpoint failures in the gas production and delivery system and electric-gas interdependence as the main cause of the magnitude and duration of the outages. Figure 1 from our Joule paper shows how far natural gas generation fell below its forecast levels (dotted lines).

Source: Mays et al. (2022), Figure 1. Forecast capacity from the Winter 2020/21 Seasonal Assessment of Resource Adequacy shown in black dashed lines. Extreme case capacity from the Winter 2020/21 Seasonal Assessment of Resource Adequacy shown in red dashed lines. Period of load shed represented by gray shaded areas from February 15 1:00 a.m. through February 19 1:00 a.m.

The FERC-NERC investigation found that

87 percent of unplanned generation outages due to fuel issues were related to natural gas, predominantly related to production and processing issues, ... Natural gas fuel supply issues were caused by natural gas production declines, with 43.3 percent of natural gas production declines caused by freezing temperatures and weather, and 21.5 percent caused by midstream, wellhead or gathering facility power losses, which could be attributed either to rolling blackouts or weather-related outages such as downed power lines.

Second, the Uri winter outages were not a resource adequacy failure, despite arguments from some that energy-only markets are inherently unreliable and from others that renewables make the grid unreliable. ERCOT had more than sufficient forecast generation capacity, even taking into account maintenance schedules and the inherently lower capacity factors (% of total hours that they generate) of intermittent renewables like wind and solar. The duration of the confluence of multiple storms, and the depth of the cold, were unusual, but if all of the forecast generation had performed as forecast they could have avoided outages.

And yet, the bills that the Texas legislature have passed or are considering treat the issue like it's a resource adequacy failure, and are not focused on natural gas production and processing. By mis-identifying the causes of the Uri outages as resource adequacy failures, the legislature will waste resources by subsidizing investment in natural gas generation capacity that will sit idle much of the time. By not focusing on natural gas production and processing, the legislature fails to induce the simple hardening of the gas infrastructure system against the problems arising from frozen water. That hardening is likely to be both more effective and substantially cheaper than subsidizing natural gas generation capacity and hampering investment in renewables.

I recommend Doug Lewin highly on this topic. First through his Twitter and now through his Substack, Doug has tirelessly followed the policy consequences of Uri since 2021, and has chronicled discussions at both the PUCT and the Texas legislature. For example, Senate Bill 6 has passed the Senate and is being deliberated in the House. Among other things, SB6 establishes the Texas Energy Insurance Program and other funding mechanisms to support the construction and operation of natural gas generating facilities that have on-site fuel storage. The program would be funded by assessments on electric utilities and by contributions from the state (in other words, from Texas taxpayers).

As Doug notes:

SB6 would put 10,000 new megawatts of gas generation — around a dozen new gas power plants — onto every Texan’s electricity or tax bill. It’s a great deal for folks who would build these gas plants. SB6 provides a guaranteed rate of return and requires Texans to pay the full cost of the plants — plus profits for generators — even if the plants become “stranded costs.”

In other words, some big generators will win, even if you lose. If the plants are a bad idea, or they’re a bad investment, or they become obsolete because technology and markets pass them by, you’ll still pay for them — AND you’ll guarantee a 10% profit for the corporations that build them.

The Senate has passed other bills (SB7 that implements cost allocation rules that shift more shared costs to renewables, SB2015 that establishes a dispatchable/controllable generation requirement and dispatchability credits system, and others), and in aggregate they will have the effect of hampering investment in renewables and increasing costs to Texas electricity customers, a point emphasized by Jinjoo Lee in a commentary in the Wall Street Journal.

The theory behind these bills, to the extent there is a coherent theory, seems to be (1) Texas needs more firm, dispatchable generation capacity to make sure that outages like that don't happen again; (2) the high share of renewables in ERCOT makes the system more brittle and less reliable because they are intermittent and non-dispatchable; (3) the long-lived federal production tax credit subsidies to wind have distorted the market and its price signals and have led to a disproportionate investment in wind (this is a corollary of point 2), a point made vividly by the Wall Street Journal editorial board; (4) therefore we need to push the market back in the direction of investing in firm, reliable gas generation and reapportion shared costs so renewables pay more, to shift the balance of the generation portfolio back toward gas.

At best, this logic is misguided; at worst, it abandons the fundamental principles of competition for consumer protection and innovation, and of independent, transparent governance in financial markets. The only point with any empirical backing is how production tax credits have distorted the market and led to more wind investment, and given them incentives to bid in very low and even negative prices so they can keep running so they earn the PTC. These distortions do not justify ruining underlying market fundamentals that instead need to be reinvigorated and refined, not abandoned. To quote Alison Silverstein from the Jinjoo Lee WSJ article, “I don't think we can fix resource adequacy in a competitive market by killing the market”.

And none of this legislative bluster – none of it – addresses the consensus root cause of the winter outages and lack of resilience: the vulnerability of natural gas production and processing to frozen water, and the vulnerability of the electric system to its interdependence with a vulnerable natural gas system. How are subsidizing natural gas generation investment and hampering renewables investment going to address that core problem? They aren't. They indicate how the Senate has politicized what is supposed to be an independent, transparent market system.

Great help in thinking through the problem, Lynne. Misdiagnosing the root causes and responding with NEW taxpayer-funded stranded assets certainly doesn't seem like a rational or helpful public policy response.

Excellent summation Lynne!