Discover more from Knowledge Problem

Anatomy of Market Failure II: Pareto-Relevant Externality

Not all externalities should be internalized

In introducing A.C. Pigou’s foundational contributions to third-part effects and external costs (and benefits) last week, I told the story of a river with a paper mill and a water treatment plant:

When marginal private value and marginal social value diverge, Pigou argues that government intervention can improve efficiency and increase welfare (“the dividend”), whereas usually government intervention through a tax or subsidy is wasteful and creates inefficiency measured as deadweight loss. Pigou’s analysis thus suggested that internalizing such costs and benefits should be done using taxes and subsidies.

The Pigouvian argument is that the paper mill is a polluter imposing a cost on the water treatment plant, a third party not involved in paper market transactions. This cost not being borne directly by the paper mill means that in equilibrium the paper mill produces “too much” paper and sells it at “too low” a price (my use of quotation marks here only specifies the place where the economic analysis is making a normative value judgement). Pigou recommended a tax on paper in the amount of the value of the third-party cost, which would realign marginal social benefit and marginal social cost, reducing waste in the river to its optimal (nonzero) amount.

Last week I critiqued the epistemic assumptions of the Pigouvian model, the assumptions of known supply and demand and known magnitude of third-party costs. Today I want to highlight a pathbreaking paper that tackled a big question: how do we define these third party effects, and do they all have to be internalized? That paper is Buchanan & Stubblebine’s 1962 paper Externality (Economica vol. 29 no. 116, pp. 371-384). This is the most important unknown paper on externality. It should be read alongside Pigou and Coase and not overlooked, because its clarity is useful and its implications are wide.

I’ve mentioned this paper before, in discussing whether or not electric grid reliability is a public good (it’s not). Of the four implications from the paper, I want to highlight the last one:

The fourth implication is that the only externalities that should matter, i.e., be policy relevant, are those that would affect the actual outcome in equilibrium. That’s what economists usually mean when we say “underprovision”. But — if there are effects on agents’ values at the margin (if my failure to invest in reliability has a significant effect on your utility), that means that there are unrealized gains from trade and we are leaving money on the table if we don’t negotiate and figure out how to internalize the effects. We could self-internalize by you paying me to invest, and if your payment is enough to get me over the hump, then I do it. If it’s not, then it shouldn’t be done anyway.

Think about this prosaic example: you are an enthusiastic gardener living in a walkable neighborhood. Your love of gardening leads you to spend thousands of dollars on trees, shrubs, and perennials to form the structure of your front garden, and hundreds of dollars every year on annuals, colorful flowers. Your garden is gorgeous and delights all of your neighbors and passers-by, but your delight in your garden is much larger than theirs (if you want to be a pedantic economist you can replace “delight” with “utility” without loss of generality). In the lingo, you have created a positive externality, a benefit to third parties who were not part of your transactions with your garden center.

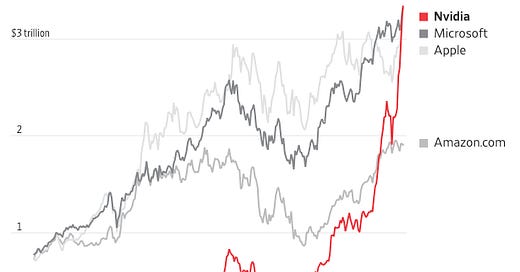

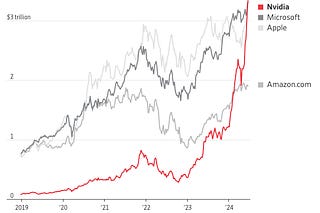

Source: The Times (UK), March 11, 2018

Does your creation of this externality mean that you should be paid a subsidy for your garden to plant more (the Pigouvian question)? How would your municipality determine the optimal subsidy given the variety of different preferences/different magnitudes of the externality experienced by your neighbors? And suppose that I, delighted with your garden, marched up to your door, rang the doorbell, and said “I love your garden, it gives me great joy, here's $20” (a private payment to you reflecting my share of the marginal external benefit). With that additional $20, would you plant more flowers?

These are the questions that Buchanan & Stubblebine tackled, and they are tough ones that economists were struggling with at the time:

Externality has been, and is, central to the neoclassical critique of market organisation. In its various forms – external economies and diseconomies, divergencies between marginal social and marginal private cost or product, spillover and neighbourhood effects, collective or public goods – externality dominates theoretical welfare economics, and, in one sense, the theory of economic policy generally. Despite this importance and emphasis, rigorous definitions of the concept itself are not readily available in the literature. (1962, p. 371)

They proceed to define externality “rigorously and precisely”; in technical terms they do so with a model of individual utility where the interdependence is made clear – the activities of another party enter into the utility function of the individual, negatively for an external cost, positively for an external benefit. They then do a bunch of cool calculus to define the marginal or incremental effect of additional amounts of that activity. Economics is a marginal way of thinking, focusing our attention on how changes in one variable do or don't have an effect on another variable, so the question of externality is whether the change in the incidence of the externality (whether, for example, the paper mill has to pay the cost associated with its water waste) changes their conduct and the outcome.

Buchanan and Stubblebine describe the economist's question as whether or not the externality is Pareto-relevant. Pareto relevance refers to the Italian economist Vilfredo Pareto (best name ever), whose equilibrium concept that we now call Pareto efficiency – a situation in which no action can be taken that makes anyone better off without making someone worse off – is a foundational component of economic theory. Think of it as a process of exchange in which people create gains from trade and keep doing so until all of the possible gains from trade have been created.

In this externality context the Pareto criterion is whether the change in the treatment of the externality changes the outcome. A Pareto-relevant externality is one that, if internalized, would lead to a reduction in output (for a cost) or an increase in output (for a benefit). In the garden example, IF I valued the external benefit I got at $20 and IF I made the payment to the gardener and IF they did plant more flowers, then my externality is Pareto-relevant because my paying them would change their conduct. But if I made the payment and they did NOT plant more flowers, then my externality is Pareto-irrelevant and the payment would simply be a transfer of surplus and not a (surplus increasing) change in the outcome.

In other words, sometimes internalizing an externality only transfers resources from one party to another and doesn't actually create any additional welfare or surplus. If internalizing an externality doesn't change the outcome, the internalizing shouldn't happen. Not all externalities should be internalized. As Buchanan and Stubblebine put it,

The analysis makes it quite clear that externalities, external effects, may remain even in full Pareto equilibrium. That is to say, a position may be classified as Pareto-optimal or efficient despite the fact that, at the marginal, the activity of one individual externally affects the utility of another individual ...

This point has significant policy implications for it suggests that the observation of external effects, taken alone, cannot provide a basis for judgment concerning the desirability of some modification in an existing state of affairs. There is not a prima facie case for intervention in all cases where an externality is observed to exist. (pp. 380-381)

Note also that one important dimension of their analysis is that different people have different values and costs, and that those values and costs are subjective. The gardener clearly has a high value for the garden and is willing to pay a lot to create it, much more than my marginal external benefit. At the margin, the gardener has spent so much and done so much that they have worked their way down their personal marginal benefit curve, so much so that their marginal benefit of additional flowers is less than $20. My paying them to do something that they have done a lot of and don't value doing more of by that much isn't going to change anything.

They also go on to analyze more complex situations in which the attempt to internalize an externality can actually be more costly, so it results not just in a surplus transfer, but actually in a reduction of surplus. I don’t want to elaborate on that case here, but it’s interesting to note that in both theory and practice, taking action to internalize an externality could make people worse off if the internalization action itself has other effects not accounted for. Economies are social systems and are therefore complex and full of interdependencies, not all of which are easily identified.

Buchanan and Stubblebine set up the next installment in this series on externality:

[I]t is useful to relate the whole analysis here to the more familiar Pigovian discussion concerning the divergence between marginal social cost (product) and marginal private cost (product).B y sayingt hat such a divergencee xists, we are, in the terms of this paper, saying that a marginal externality exists. The Pigovian terminology tends to be misleading, however, in that it deals with the acting party to the exclusion of the externally affected party. It fails to take into account the fact that there are always two parties involved in a single externality relationship.fn2 A s we have suggested, a marginal externality is Pareto-relevant except in the position of Pareto equilibrium; gains from trade can arise. But there must be two parties to any trading arrangement. The externally affected party must compensate the acting party for modifying his behaviour. The Pigovian terminology, through its concentration on the decision-making of the acting party alone, tends to obscure the two-sidedness of the bargain that must be made. fn2: This criticism of the Pigovian analysis has recently been developed by R. H. Coase; see his " The Problem of Social Cost ", Journal of Law and Economics, vol. m (1960), pp. 1-44. (p. 381)

Next: I'm on vacation next week, but in two weeks, what if people can use the legal system and social norms to internalize Pareto-relevant externalities? Yes, time to talk about Coase!

Subscribe to Knowledge Problem

Economics, regulation, technology, governance

Hi Lynne, just wondering about the place of honor in the analysis. Certainly, if we care for our neighbor, then the system will be more efficient. If the paper mill owner considered the interests of the community and the fish in the river above profit, "honoring" these things, even though a law did not yet exist to counterdict polluting behavior, then the system would be closer to global optimum without the need for the regulatory effort. The lack of time spent developing regulations can be seen as an efficiency gain. But you also need a population that honors good and doesn't buy paper from the unscrupulous unregulated paper mill. (In that sense, it seems that globalization harms the efficiencies and beauties of honor since it lives outside the local relationships where honor can thrive.)

Or thinking of the gardener--one of her/his motivations is likely the joy that the garden brings to the neighbors. My expression of joy (whether to stop and admire, share kind thanks, or give $20) encourages the gardener. This honor is not required. Does it fit into the Pareto equilibrium discussion? As you say, "economies are social systems and complex". It seems to me that a wise city council recognizes and honors the beautiful positive externality while on the flip side regulating or removing the unjust negative externality. I think there are also just negative externalities, such as the profitable business or economically-stable citizen caring for the poor. Honor creates efficiency gains, gains in joy and positive relationships, gains in sharing surplus with those who are in lack creating a more equitable society, etc.

David

Good stuff. I would further emphasize the point that attempting to internalize externalities may be too costly. In the real world, as distinct from idealized economic models, we know that interventions in market are rarely, if ever, driven solely by sound economic theory. It is unrealistic to give politicians and bureaucrats a mandate to "internalize all externalities" and to expect it to be used without error, bias, or hidden agenda.